I attended the panel discussion about leveraged investing on 12th October 2018 and here are 10 takeaways from the seminar that I have learnt.

The panel was moderated by Richard Dyason, representing Securities Investors Association (Singapore) SIAS. The panelists were David Kuo representing SIAS (from Motley Fool), Margaret Yang representing SIAS, Wong Chin Loon representing CFS Society Singapore and Wong Kon How representing SGX Academy.

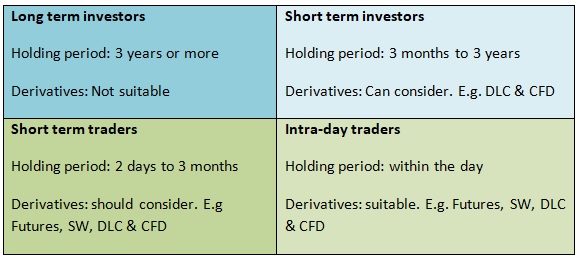

1. Which type of investor or trader are you?

Kon How shared how one should find out one’s own investor personality to see if leveraged investing is suitable.

Kon How shared the 4 investors and traders types and mentioned that derivatives are suitable for some and not others.

Legend:

DLC: Daily Leveraged Certificate

CFD: Contract for Difference

SW: Structured Warrant

This is the summary of some derivatives and their leverage ability:

DLC: 3x, 5x, 7x

Structured warrants: 7x to 25x

Futures: 35x

Options: Time

2. Leveraged investing is not suitable for all and should be a small part of a person’s investment portfolio

Chin Loon shared that from institutional perspectives, a person should plan and build a portfolio that is stabilised. For leveraged investing, it is used for hedging. Leveraged investing forms only a small part of the portfolio and should be considered as “play money”. A person should only think about leveraged investing after the main portfolio is planned because it is likely you would need to pay your “school fees” when you do leveraged investing.

“Leveraged investing will not be suitable for all, depending on one’s personality, skills and risk appetite”, Margaret Yang echoed Kon How.

David Kuo felt that leveraged investing might be suitable if you are an active trader.

3. Build an investment portfolio like a pyramid

David Kuo advised that an investment portfolio should look like a pyramid. The base 60% should be income shares, 30% should be growth stocks and for the remaining 10%, you can be more adventurous with it and do whatever you want with it. They can use the 10% to trade, to buy some cryptocurrencies etc. David uses the 10% to buy valued shares, like when value shares’ prices dropped during recent uncertainty and fears.

During the Q&A, there were some interesting questions being raised. Here are some of them. As cryptocurrency is a hot topic in recent times because of the multiple rise in prices, there were several questions on cryptocurrency.

4. Is cryptocurrency a form of leveraged investing?

The short answer is no. Crypotocurrency is just like any underlying instrument, unless you are buying futures crypotocurrency which is a form of leverage.

Chin Loon gave some background to cryptocurrency and mentioned that it was not invented as a form of investment. The technology behind it is a distributed ledger, blockchain. Cryptocurrency is an alternative currency. As there is a limit to the amount of cryptocurrency that can be created, due to demand and supply, people feel that with limited supply, price will go up, so people start to speculate.

Chin Loon compared cryptocurrency investing to share investing. When you invest in shares, value is being created, i.e. the company creates products or services and earns revenues. However, what is the reason behind the price fluctuation of cryptocurrencies? Chin Loon sounded a word of caution as there seemed to be no particular reason for the price fluctuations.

Chin Loon also shared that the differences between cryptocurrency and gold. With the government printing more money, the value of money will drop and thus people might revert back to using gold.

5. Cryptocurrency is not an asset class

David Kuo explained that crypotcurrency is not an asset class. David added that there are only 4 asset classes he knows of and they are cash, bonds, properties and shares. Gold and silver are also not considered asset classes. To qualify as an asset class, it needs to give value. Cash gives interest, bonds gives coupons, properties gives rent and shares gives dividend.

David believes that there is future in cryptocurrency but which one will become the dominant one e.g. bitcoin, ethereum etc, we do not know. Some people believe that bitcoin will go up to $1 million while others said it can go down to $0. When such things are said, this means we do not know how to value cryptocurrency. For example, when price of the cryptocurrency goes up from $100 to $1000, we do not know why the price goes up.

6. Top 2 reasons why my clients lose money in CFD trades

Margaret candidly shared that less than 30% of CFD traders made money consistently. So, what did the other 70% do wrong?

Margaret explained the meaning of leverage in CFD. For example, if the CFD margin is 10%, it means the leverage is 10x (1/10=10x). If the margin is 5%, the leverage is 20x (1/5=20x). The lower the margin required, the higher will be your leverage.

The first reason why CFD traders lose money is that their trades are being forced closed. To prevent force closing, one should have some buffer in your trading account so that you won’t get margin calls and your positions won’t be forced closed because you fail to top up your account during a margin call. One should also set a profit target and stop loss position, which allows you to take profit when price goes up to your target price and also lessen your losses when price goes the other direction from your prediction.

The second reason is that most traders risk too much of their capital. Successful traders only risk 1% to 3% of their capital on each trade. Risking too much will cause a huge drawdown on your account when your trade goes against you. However, some people asked Margaret what if the market gap down e.g. 4% to 5%, which means it falls below your stop loss level and your stop loss doesn’t work? Margaret shared that you can use a guaranteed stop loss feature that will close off your trades at the stop loss you have set in the event of a gap down in the market.

7. Rationale behind investing and trading

Chin Loon shared that the rationale behind these two types of investment styles.

Investing is for long term as the rationale is that the company needs time to generate profits. Trading is for short term as the rationale behind it is price action movement.

Chin Loon advised that when investing, we should have a profit target, and once we hit the profit target, we should get out as if we still keep the position, there is higher chance for the market to go down.

8. Leveraged investing is just like making a guess

David Kuo illustrated this point by asking the audience some questions.

Using STI Friday’s closing of 3069 points as a reference, he asked: “Who think the STI will close above 3069 points next Monday?” Several people raised their hands.

“Who think the STI will close below 3069 points next Monday?” Again several people raised their hands.

“Who have no idea?” This time, many more people raised their hand.

“But do you think STI will close higher than 3069 points 10 years later.” This time round, the opinion was unanimous. Thus, David reiterated that we do not need to guess how the market will move next day, or next week, but invest for the long term.

David has a strong opinion against leveraged investing and prefers long term investing.

9. Investing and trading can go hand in hand

However, Margaret is of the opinion that investing and trading can co-exist. She has one portfolio in investing and one in trading. She also advises her clients to just have 5% of their portfolio in trading. She mentioned that some clients might want some excitement so they do some trading. This comment led to a small argument between Margaret and David when David commented that investing is not meant to be exciting. It is meant to be boring. If it is exciting for you, then you are doing something wrong.

At the end, Margaret explained her point that there are benefits in the availability of derivatives. For example, she shared that there was an event that happened that caused the price of bit coin to drop from its high to $6k and that it was the start of trading of bit coin futures, which allow people to short bit coin. So, shorting allows bit coin prices to go back to more “earthly price”.

10. Trading needs volatility and volume

When someone asked if we should only trade when there is volatility, Kon How advised that there are 2 criteria to trade, firstly the market must be volatile, i.e. there must be movement in the market and secondly, the product must be liquid, i.e. there must be sufficient volume. But Kon How advised that one must know the derivatives products one like to use before starting.