At the start of the first lesson of SGX CSP Module 3 Fundamental Analysis course, I-Min shared how someone using Fundamental Analysis invests using these three points:

- See investing into companies as buying into companies

- With the intention to hold the stock for 3 to 5 years

- Invest into the company because the company is profitable.

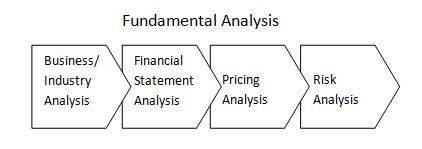

Fundamental Analysis investment process

I-Min uses this chart for his investment process:

If I-Min has an hour to do analysis, he will spend 45 minutes just on business and industry analysis. We need to know what business the company is in and the business model of the company.

Next, we need to look at the market drivers. We could analyse the critical success factor using SWOT analysis. We can find the competitive advantage of the company over other competitors using Porter’s Five Forces Model.

Look for industry trends. Ask yourself: what do you think the world will be like in 5 to 10 years’ time. What companies are likely to profit?

Six financial ratios to check before investing

Using financial statement analysis, I-Min shared the 6 ratio tests to shift out good companies.

- Profit is positive for the last 5 years, better if increasing trend

- Profit margin > 5%

- Current ratio > 1

- ROE > 15% (For growth stock only. No need to meet this percentage if you are looking for dividend stock)

- Debt/Equity < 2 or 200%

- Interest cover > 3

Is the stock price right?

A company needs to meet all 6 criteria before I-Min will consider buying it, although I-Min honestly shared that he would sometimes buy into companies that do not meet all 6 criteria, and most likely he would lose money in these companies. I-Min commented that humans have emotions, so sometimes this is unavoidable.

Of course, we also do not buy into a company immediately when it meets all 6 tests. We will put it into a watchlist, and check if the price is right. We will only buy if the price is also right. Pricing analysis will be covered in the third lesson.