Beginner investors, hearing of gurus’ successes, might wonder if there is a holy grail in investing. It seems that the gurus have found winning strategies that constantly give them success in their investments. But as one of the speakers at VIS 2016 reminded us, “There is no right strategy for everyone. There is no mantra. You need to be true to yourself.”

I was one of those beginner investors who used to wonder if those gurus have found the “right” strategy to achieve their investment success. But as I delve into the world of investment, the more I learn, the more I understand that like life, there are many routes to the success story. Although still a rookie investor, I discovered that there is no one size fits all strategy. Each guru achieved his own success by integrating his knowledge and experience with a strategy that is true to him.

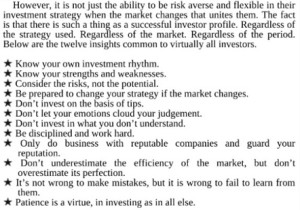

The good news is that although there is no mantra, the book “The World’s 99 Greatest Investors: The Secret of Success” by Magnus Angenfelt shows us that even if different strategies and instruments are used, there is a set of 12 criteria which he found to be common to most of those investors.

A common thread that I noticed in the 12 criteria is that you need to be true to yourself. More than half of those criteria focus on knowing your own personality, your investment style and adjusting your style according to new knowledge or experience gained.

It seems that before you can allow your investments to work for you, you need to work on yourself. “Know thyself”- it might be the best investment you have ever made.

That’s my third and last takeaway from VIS 2016. I hope my sharing has been useful for you.

> Read the first takeaway and second takeaway of VIS 2016.