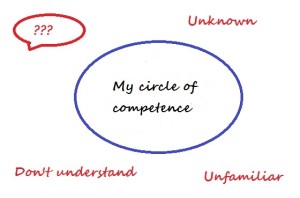

In my first takeaway from VIS 2016, I wrote about the idea that it’s never too late to start investing or to start anything. I hope for those who have not yet started in their investment journey, it has ignited the motivation in you to begin your journey today. In several seminars that I went to, the speakers always talk about investing in your circle of competence. So, for my second takeaway, I would like to write about this principle of investing only in what you understand.

Investing based on tips or rumours without knowing anything about the stock you’re investing in is like gambling. Let’s say you’re lucky and the person who gave you “the tip” has done his due diligence and research into the company and the company is a good stock to buy at that point in time. However, when you do not understand why it is a good business, you would not know if the business turns bad in the future and it’s the time to get rid of the stock.

When you invest in a company, you are buying a part of the company. You become a business partner with that company. A good analogy some speakers give is: “if your friend asks you to invest in his company, what type of questions would you ask”? Wouldn’t you ask your friend: “does your company make money”, “what is your company selling or what service is it providing”, “how is sales”, “are your customers local or international” etc?

This principle of investing in your circle of competence was also shared by several speakers in VIS 2016 seminar. I recalled that an audience posed a question to the panel discussion that with the price of oil dropping, what’s their take on how to invest?

One of the speakers said that he only invested a small portion of his portfolio in oil and gas as he doesn’t know much about oil and gas sector. Regarding Keppel Corp and Sembcorp Marine, he said that he doesn’t understand the business of the companies much and he has no answers to whether the companies will make money in 5 to 10 years’ time. You can see that the reason he only invested very little in oil and gas sector is because the sector is outside his circle of competence.

I hope the second takeaway has been useful for you. I’ll share my third takeaway from VIS 2016 in another day.